Capital

Capital refers to all human productive assets used to produce other goods and services. They are also referred to as investment goods or producer goods. They are goods that do not necessarily give direct satisfaction but are used in production of consumer goods, services, and other capital goods. Example of capital include money, machines, tools, factory buildings, raw materials, fuel, stocks of partly finished goods, and so on.

Capital is a passive factor, for without the application of human effort, the assets are useless in themselves. The reward accruing to capital is called interest.

Importance of Capital

Capital is important in the following ways;

It facilities mass production of goods and services. For example, by using machinery, the output of goods and services will be increased.

Capital allows work to be done which otherwise would be quite impossible. Example, the use of computer to perform complex operations.

Capital increases the quantity of work which can be done per man/hour. For example, a man using a tractor to clear farmland would do more work than another who uses bare hands or even cutlass.

It helps to improve quality of products by facilitating higher standards of accuracy. Example, the quality of machine-made metal pots are higher than those hand-made ones.

Provision of adequate capital makes for the smooth running of a business enterprise. For example, money which is used for purchasing raw materials, making payments to labour and purchasing necessary equipment is a form of capital.

Types or Forms of Capital

- Fixed Capital

- Circulating Capital or Working Capital

- Social Capital

Fixed Capital

Fixed capital consists of the long-term producer goods of a firm. In other words, they are the durable investment which require renewal only at fairly long intervals. Fixed capital does not change its form in the process of production. It includes items such as factory buildings, machineries, tools, and office equipment.

Circulating Capital or Working Capital

Working capital consists of capital goods which either change their form or are used up in the process of production. Some of them may be changed into finished goods. Most forms of circulating capital are required on a regular basis in order to maintain production. It includes things like raw materials, stock of partly finished goods, fuel, money set aside for the payment of wages and salaries, and debts owed to the business customers and suppliers.

Social Capital

Social capital is made up of those capital goods which are collectively owned, that’s , the social infrastructure. Social capital consists of a nation’s or a community’s stock of social assets such as hospitals, schools, roads, electricity, pipe-borne water, etc.

Some of these social assets may not be directly connected to production, but they help to improve the efficiency of labour and raise the standard of living. For example, if a worker is well educated, healthy and properly housed, he will be able to work efficiently.

Reasons for Low Capital Formation in Nigeria

There are a number of factors resulting to the low capital formation in Nigeria. Here we discourse some of them:

- Poverty Vicious Circle

- High Consumption Propensity

- Inequitable Income Distribution

- Governments' Misappropriation of Public Funds

- Low Savings Incentive

- High Interest Rates

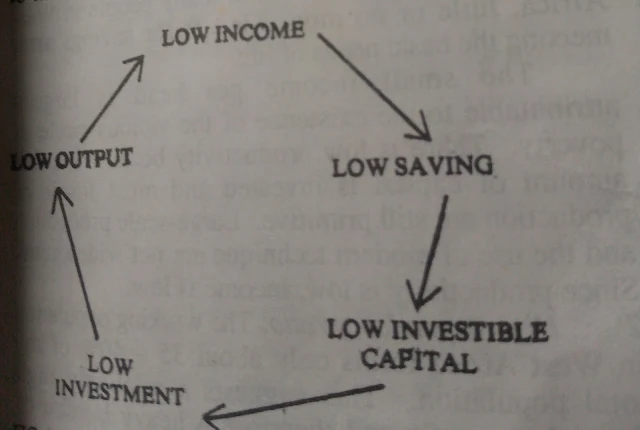

Poverty Vicious Circle

The low rate of capital formation in Nigeria is largely due to the existence of a vicious circle of poverty. There is is a low income which results in low savings. Law savings results to in a shortage of capital for investment, and this in turn results in low investment. Low investment leads to low output, and consequently to low income. Low income results again in low savings , and the vicious circle continues. For this reason, capital formation continues to be low.

High Consumption Propensity

In Nigeria, the propensity to consume is generally higher than the propensity to save and invest. Nigerians have high taste of foreign and imported goods. The high propensity to consume couples with low income result in low savings and investment.

Inequitable Income Distribution

Capital formation in Nigeria is hampered by an inequitable distribution of income. Rich people make up a small fraction of the population, while the poor make up the majority.

The few who are rich like to hoard their money, save it in safe havens abroad, or lavish it on expensive projects that are non-productive. Some others engage in expensive burial ceremonies, throwing parties and living in luxury. Some of those who invest have their majority investment on short-term projects like importation that can yield revenue quickly. While the larger percentage who have good business acumen are poor with little or no money for investment. For this reason, investment is low and capital formation continues to be low.

Governments Misappropriation of Public Funds

Governments at different lives in Nigeria are involved in reckless spending. Government business is characterized with corruption, where government officials siphon public funds. Many of them engage in prestigious but non-productive projects. Revenue is spent on jamborees, buying luxury vehicles, parties, hosting international conferences, and so on.

Low Savings Incentive

There is little incentive to save. Despite the CBN’s financial include strategy framework with the advent of Fintech companies that make saving easy, interest on the savings are not encouraging as the charges by banks and Fintech apps more than the interest accruing to the savings.

High Interest Loan

The poor how have business acumen find it difficult to raise capital through bank loans the interest rates in Nigeria are outrageous. Banks and other financial institutions charge as high as 35% interest rate on loan facilities with other stringent conditions that are very hard to meet, thereby making capital formation to be low.

Reasons for Low Personal Savings in Nigeria

Many individuals find it difficult to save many in Nigeria for so many reasons

Low Income

Income per capita in Nigeria is very small compared with that of other economically advanced countries. As of 2024, Nigeria’s per capita income is $1,109.9, a decrease from $1,687.57 in 2023 following the devaluation and continuous depreciation of the naira. While that of the United States of America is $85,370. This shows that Nigerians are becoming poor by the day. In 2022, Nigeria’s GDP per capita was $2,202.46. With the ailing economy and rising inflation, little or no money is left for savings after meeting basic needs of life.

The small income per head is largely attributed to the existence of the vicious circle of poverty. There is low productivity because a small amount of capital is invested and most forms of production are primitive especially in the agriculture sector. Large-scale production and use of modern techniques are not widespread. Since productivity is low, income is low as well.

High Dependency Ratio

Unemployment rate in Nigeria in real sense is above 33%, although the data from National Bureau of Statistics say it’s 5.0%. This after the statistics office changed the indices in determining who is employed in Nigeria. According to NBS, anyone that works for at least 1 hour per day is employed. This is in contradiction to monthly wage payment model that is obtainable in Nigeria. Some who works for at least 1 hour per day can only be said to have a job, in a county where wage payment is made per hour. The working population in Nigeria is about 76 million as of 2023. That is just a 34% of population of 223 million people. This suggests high a relatively high dependency ratio and therefore a heavy burden of responsibility on the income earners. From their meager incomes, many workers cater for their children, siblings, parents, and other relatives, who have little or no means of livelihood.

This is a common phenomenon in Nigeria due to the existence of the extended family system. The meager resources of the average worker are therefore drained easily and he may even go borrowing to make both ends meet.